Living under a pandemic taught us to rely more on our personal devices to do things, perhaps such as order food, shop with curbside pickup and stream movies. Even routine tasks like banking proved to be easy and convenient on our smartphones and tablets. Whether or not you still prefer not to visit a bank in person (or it’s just hard to make it to one during your busy day) you should consider taking advantage of the many benefits mobile banking offers.

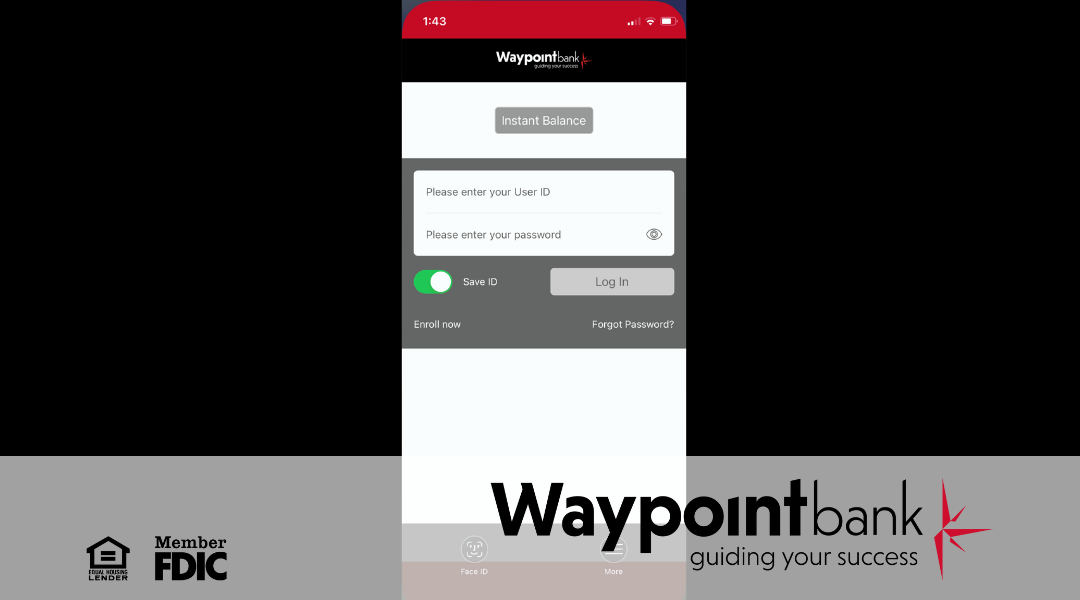

Probably the most convenient and time-saving aspects of online banking is being able to take care of finances on the go. You can transfer money, pay bills, and check account balances securely from anywhere right from your mobile device. If you forgot to pay a bill before you left for vacation, you can pay it while away from home. You can even deposit a check by taking photos of the front and back of the check with your device’s camera. (No having to remember where your kids (or even you) put grandma’s check.)

Being able to monitor finances from anywhere lets you check your account(s) for any fraudulent activity and immediately take action if necessary. As a further precaution, you can set up alerts to notify you when any large or unusual purchases are made. We encourage you to take advantage of this free banking feature.

Mobile banking even helps you budget and keep track of your spending in real time. So, if you’re on a holiday shopping spree, you might want to check your balance before you walk into another store so you’re not over spending!

Finally, when you download a banking app, like Waypoint Bank, it is absolutely free. There is no cost to reap the benefits of mobile banking!

Waypoint Bank strives to be an exceptional provider of superior financial solutions that promote the small-town approach of putting the customer first while earning their trust in the most friendly and professional manner possible. To learn how to download the Waypoint Bank app, visit our website here.