Is your child ready to learn about money? Not sure how to teach them? Keep reading for some tips on teaching kids about financial basics.

Start with an allowance

Have your child do chores around the house, or earn good grades at school, to earn an allowance. It can be something like earning a few bucks for doing the dishes. Or every time they take out the trash. Or make their bed. You decide what they can earn money for, and how much. Once they get to the end of the week, you can pay them and discuss with them what they can do with the money. This will get them to learn early about the power of hard work.

Get them a piggy bank

When they are earning an allowance, or doing jobs around the neighborhood to make money, they should have somewhere to put their funds while waiting to go to a Waypoint Bank branch to make a deposit. Getting them a fun piggy bank is a great way to get them excited about saving their money. Set them up with a Waypoint Bank savings account today!

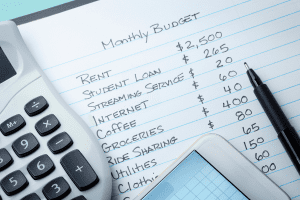

Show them a budget

Depending on how old your children are, sharing an example budget with them can be powerful. You can be general about it as well without telling them how much money you actually make. For example, if you make $3,000 a month, show them how much goes towards rent/mortgage (33% or less as a rule of thumb). Then subtract out funds for groceries, utilities, internet, gas, vehicle, entertainment, clothing expenses, etcetera. Lastly, show them how to calculate whether they were over or under on their budget.

Set an example with your own money habits

When teaching kids about money, it’s better to show them than to tell them. Set a good example by avoiding impulse buys near the register, finding the cheaper option at the grocery store, and doing price comparisons to find the best deal. If you talk with your kids about how you spend your money, and why you decide to buy an item or not, they will learn from you.

Waypoint Bank is here to guide your success, and your children’s. It is never too early to start teaching your kids about money. To learn more, check out our other blog on this topic. Happy Financial Literacy Month!