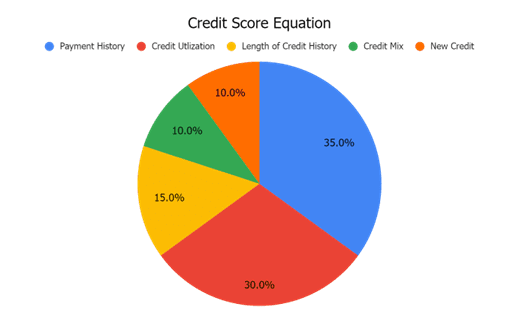

We are diving into the elusive credit score equation, and what you can do to improve your credit score.

Your credit score is more than a number. It’s used to determine your creditworthiness, or your likelihood of paying back a loan. Whether you are applying for a loan, credit card, or even renting a home or apartment, your credit score will determine if you qualify, and what interest rate you qualify for. Ever wonder how the credit bureaus come up with their scores? There are five factors that contribute to the score Experian, Equifax and TransUnion assign you.

Payment History

The foundation of your score lies in your payment history. Think about it: would you want to loan money to someone who has a history of not paying it back? Probably not. This factor accounts for 35% of the credit equation. Timely payments on credit cards, loans, and other bills contribute to an increase in your score, while late payments, missed payments and bankruptcies can have adverse effects. Expect over a 100-point decrease when you miss a payment, and it takes months, even years, to build your credit back up after that.

Credit Utilization

This refers to the percentage of your available credit that you’re currently using. Lenders assess your ability to manage credit responsibly by looking at this ratio. It is ideal to keep this at 30% or less. Example: If you have $10,000 in available credit and you currently have a $3,000 credit card bill, then you are at a 30% utilization rate. If this gets above 30% for multiple months, it will negatively impact your score. The lower you keep it, the better your score. It demonstrates that you know how to manage your money in a responsible manner and not overspend. This factor accounts for 30% of the credit equation.

Length of Credit History

Generally speaking, a longer credit history provides more data for the lenders to evaluate your financial habits. For this factor they are looking at the age of your oldest account, the average age of all of your accounts, and the age of your newest account. Because this accounts for 15% of your credit score, it is important to keep your oldest accounts open as long as you can. If you have a credit card that you opened when you were young, keep that open. Even if you don’t use it much, you can put just one charge on it every month, pay it off and that will keep it open and contribute to a longer credit history.

Credit Mix

Diversity in the types of credit you have can be good for your credit score. Lenders like to see a mix of installment loans such as mortgages and car loans, and revolving credit such as your credit cards. You must manage these various credit types responsibly though, and not sign up for a new loan just for the sake of increasing this factor. Credit Mix only contributes to 10% of the equation.

New Credit

Opening multiple new lines of credit within a short period of time can be a huge red flag for lenders. Each application for new credit will result in a hard inquiry. This can slightly reduce your credit score for a short period of time. It is recommended to not apply for more than 6 forms of new credit per year and be sure to spread those applications out. New credit is okay, just not all at once. We don’t recommend getting a mortgage and a car loan in the same month, or even within 3 months of each other. This factor accounts for 10% of the credit equation.

Keep your credit score in check by monitoring how you’re doing with each of these factors. If you need to check your credit report, head to annualcreditreport.com. Looking to rebuild your credit score? Check out our blog on this topic. Happy Credit Education Month!